Iredell County Real Estate Tax Lookup

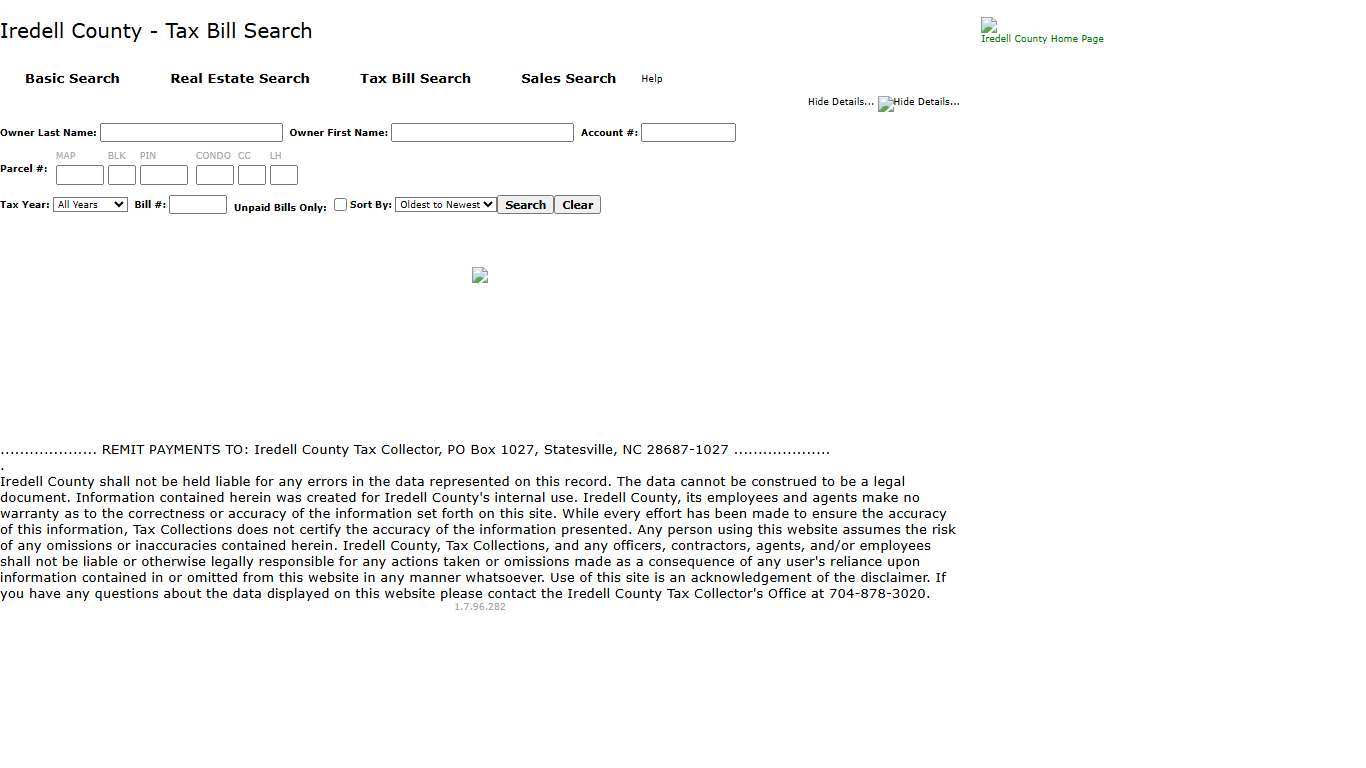

Tax Bill Search

Real Estate Search, Tax Bill Search, Sales Search · Help. At least one field ... 2026, 2025, 2024, 2023, 2022, 2021, 2020, 2019, 2018, 2017, 2016. Bill #:, Unpaid ...

https://taxweb.iredellcountync.gov/PublicAccess/TaxBill.aspx

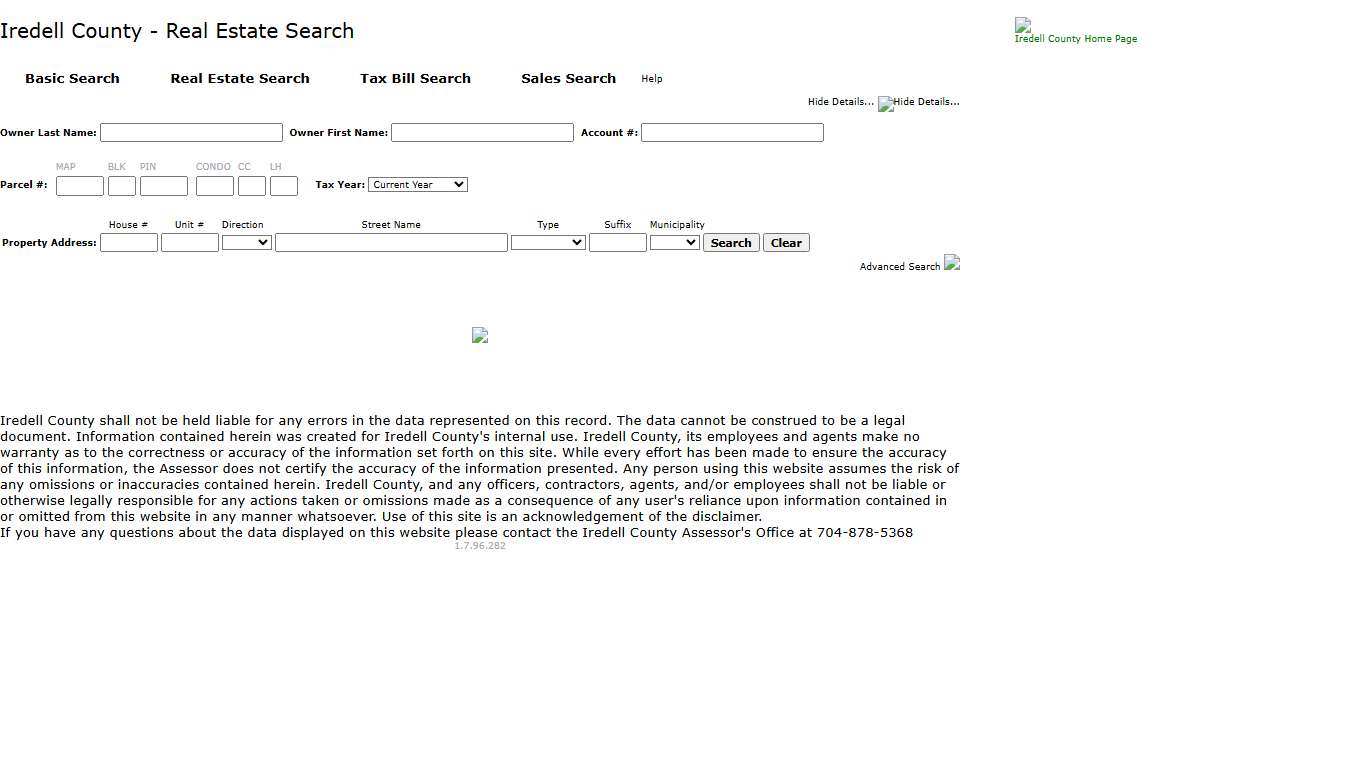

Real Estate Search

Tax Year: Current Year, 2026, 2025, 2024, 2023, 2022, 2021, 2020, 2019. House #, Unit #, Direction, Street Name, Type, Suffix, Municipality. Property Address:.

https://taxweb.iredellcountync.gov/PublicAccess/RealEstate.aspx

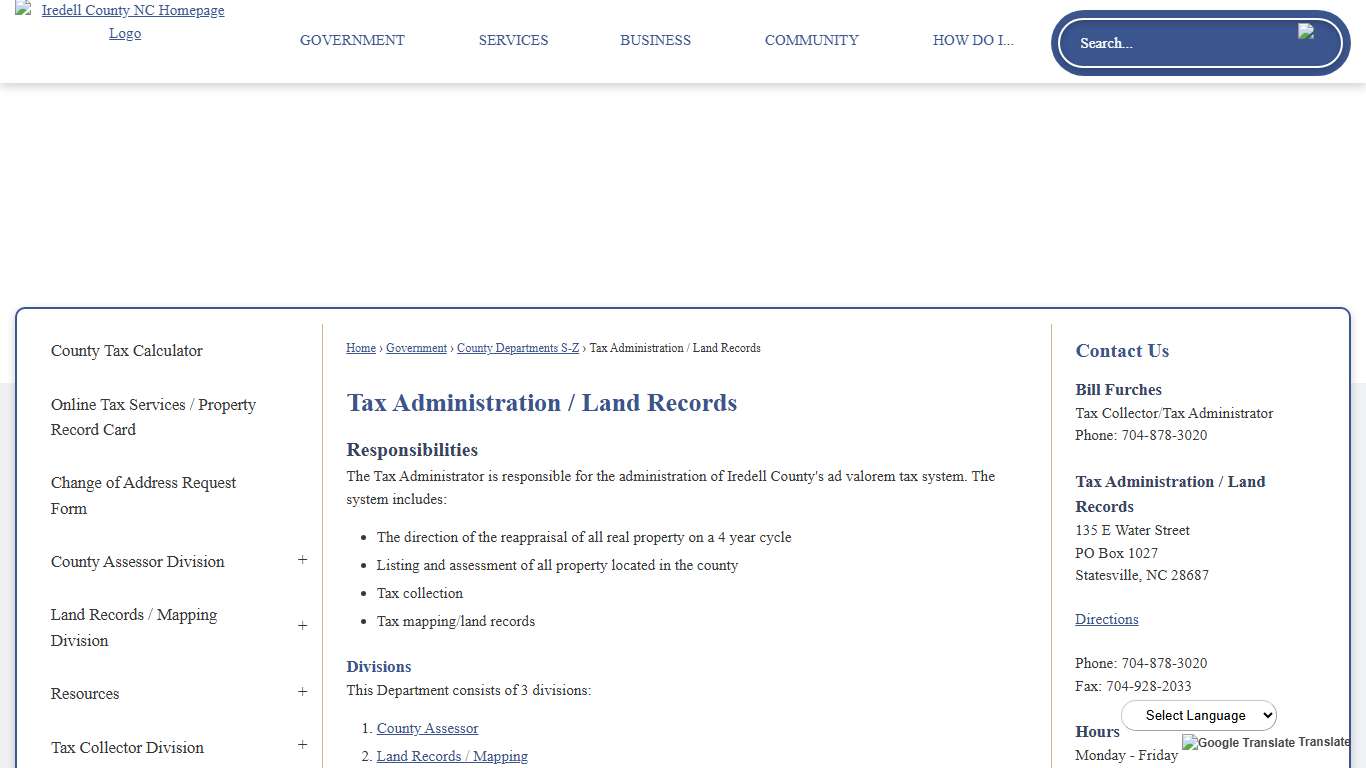

Tax Administration / Land Records Iredell County, NC

Find out all there is to know about the Iredell County Tax Administration including property records, tax rates, frequently asked questions and more.

https://www.iredellcountync.gov/368/Tax-Administration-Land-Records

Iredell GIS Iredell EDC

Iredell County hosts a GIS site which includes interactive maps and information related to tax data, floodplains, zoning, topography, election jurisdictions, and other geographic data. See the help page for website instructions.

https://iredelledc.com/property-search-2/iredell-gis/Untitled

Land Records / Mapping Division · Resources · Tax Collector Division · 2026 Real & Personal Property Tax Listing Form · Open the County Assessor Division page ...

https://iredellsheriff.com/Pages/MenuSecondary/HiddenSecondarySubMenus?pageID=787&moduleID=&themeID=1&menuContainerID=secondaryNavIredell County Property Records Owners, Deeds, Permits

Instant Access to Iredell County, NC Property Records - Owner(s) - Deed Records - Loans & Liens - Values - Taxes - Building Permits - Purchase History - Property Details - And More! Iredell County, North Carolina, has six towns and cities.

https://northcarolina.propertychecker.com/iredell-county

Property Taxes in Iredell County, NC

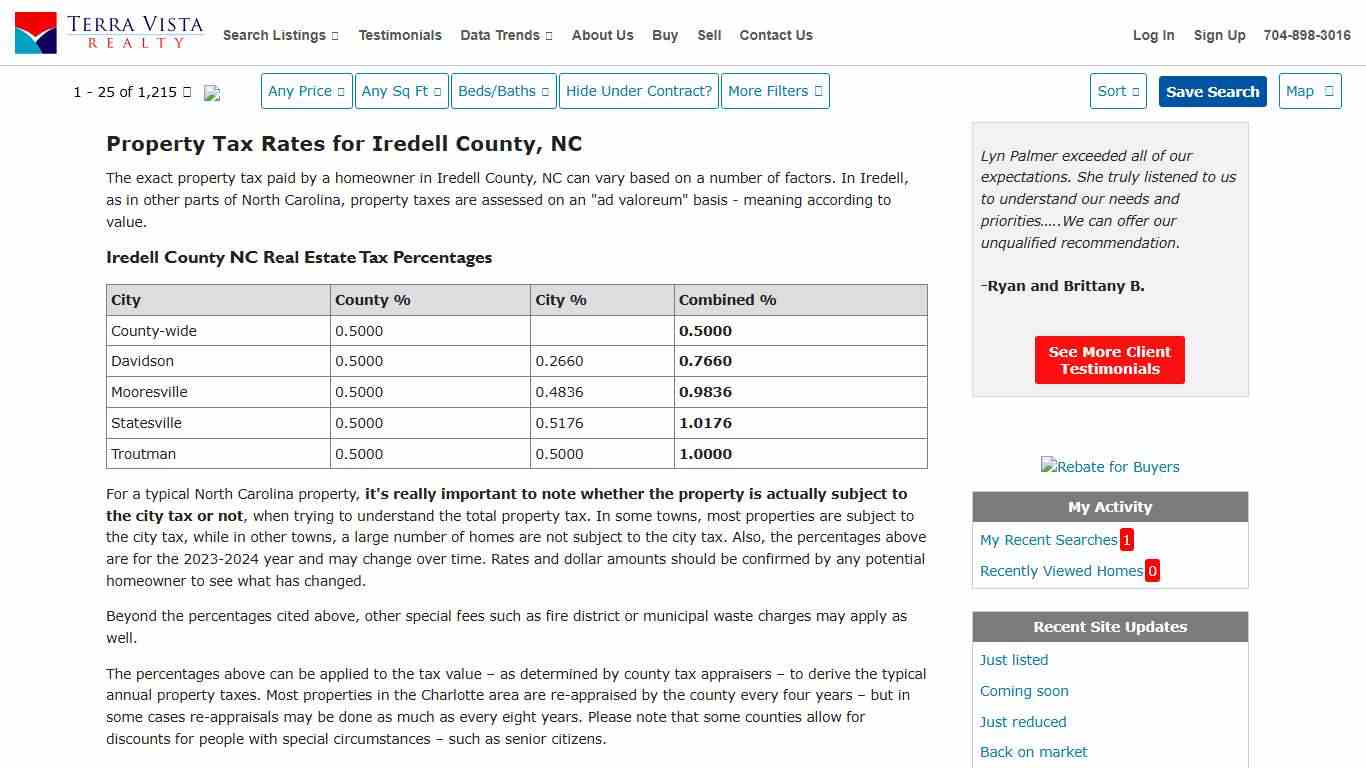

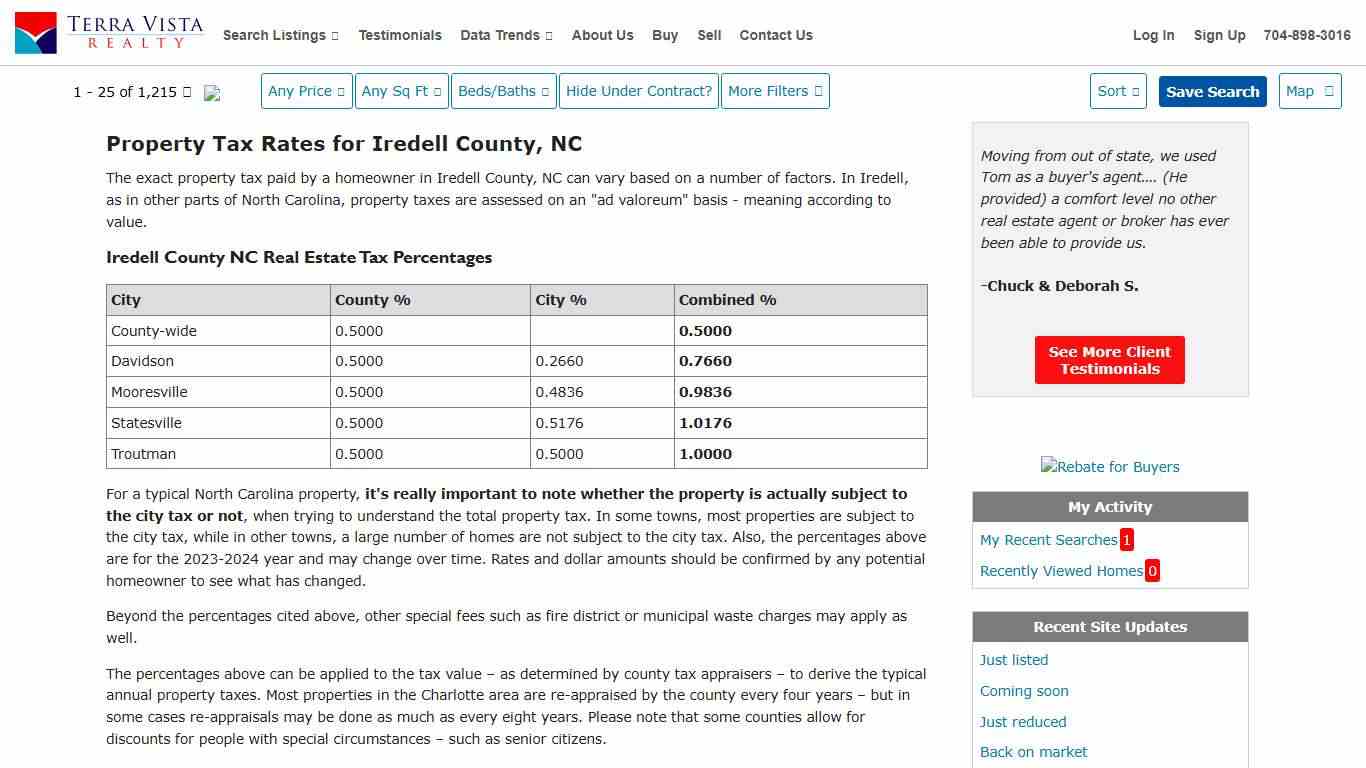

Property Tax Rates for Iredell County, NC The exact property tax paid by a homeowner in Iredell County, NC can vary based on a number of factors. In Iredell, as in other parts of North Carolina, property taxes are assessed on an "ad valoreum" basis - meaning according to value.

https://www.terravistarealty.com/property-taxes-iredell-county-nc.cfm

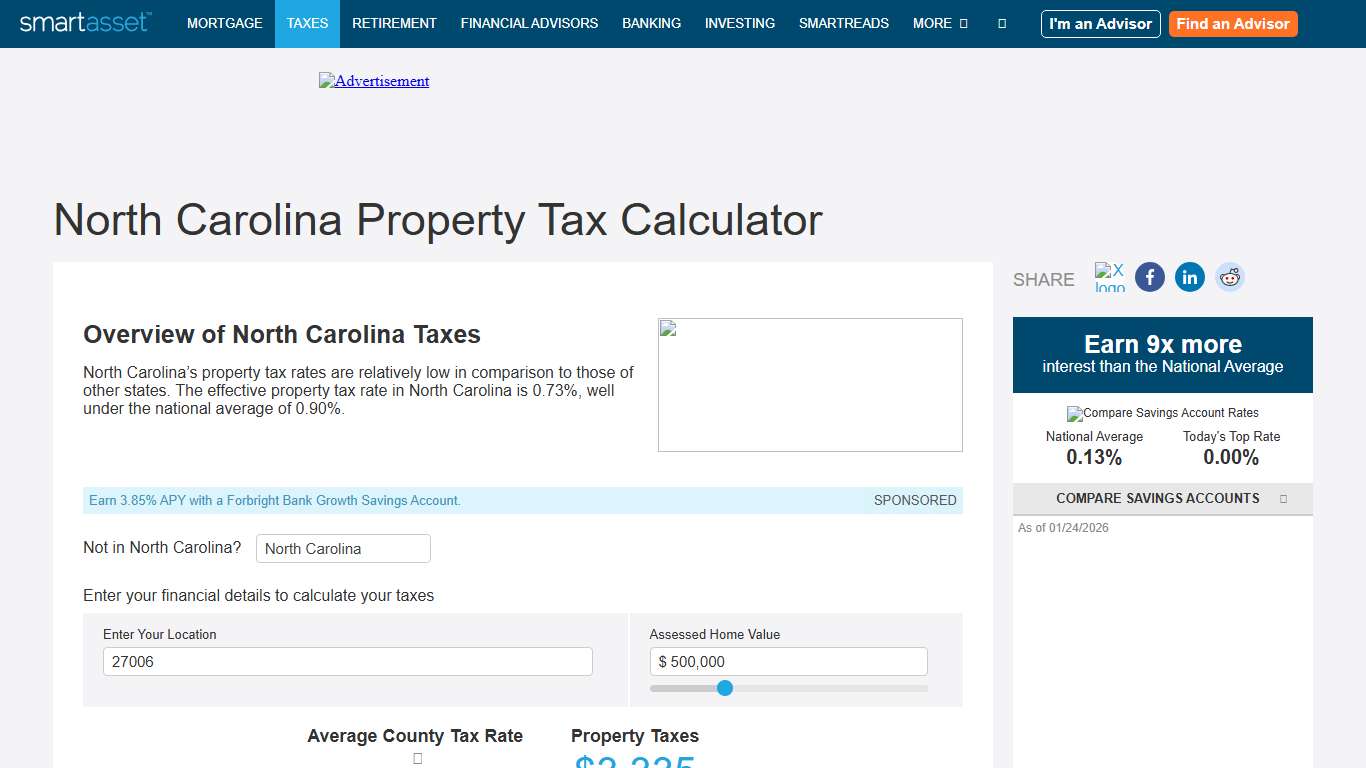

North Carolina Property Tax Calculator - SmartAsset

Overview of North Carolina Taxes North Carolina’s property tax rates are relatively low in comparison to those of other states. The effective property tax rate in North Carolina is 0.73%, well under the national average of 0.90%. - About This Answer To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address.

https://smartasset.com/taxes/north-carolina-property-tax-calculator

Property Taxes in Iredell County, NC

Property Tax Rates for Iredell County, NC The exact property tax paid by a homeowner in Iredell County, NC can vary based on a number of factors. In Iredell, as in other parts of North Carolina, property taxes are assessed on an "ad valoreum" basis - meaning according to value.

https://www.terravistarealty.com/property-taxes-iredell-county-nc.cfm

Delinquent Taxpayer Lists Office of the Tax Collector

Delinquent Taxpayer Lists The North Carolina General Statutes (NCGS) provide taxing jurisdictions with several collection remedies to enforce collect delinquent taxes. These remedies include, but are not limited to: Attachment and garnishment of funds due to the taxpayer Seizure and sale of personal property Seizure of state income tax refunds and lottery winnings Foreclosure of real estate The lists below are published to notify taxpayers of ...

https://tax.mecknc.gov/services/Delinquent-Taxpayer-Lists

North Carolina Property Tax Calculator - SmartAsset

Overview of North Carolina Taxes North Carolina’s property tax rates are relatively low in comparison to those of other states. The effective property tax rate in North Carolina is 0.73%, well under the national average of 0.90%. - About This Answer To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address.

https://smartasset.com/taxes/north-carolina-property-tax-calculator

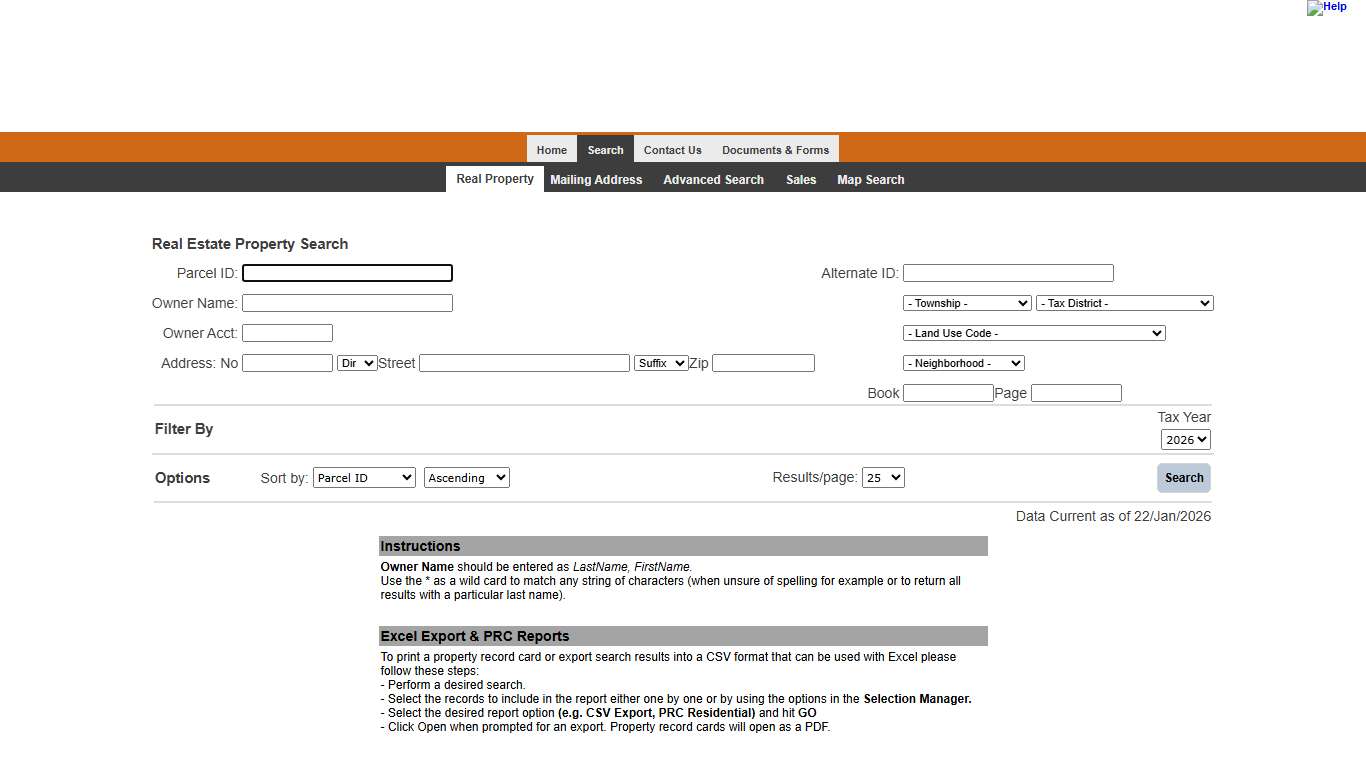

Wilkes County Tax Administration - Real Estate Property Search Search

Disclaimer The Tax Assessor makes every effort to produce the most accurate information possible. No warranties, expressed or implied are provided for the data herein, its use or interpretation. The assessment information is updated periodically and may or may not represent changes either in ownership or physical characteristics from the last certified tax roll.

https://parcelinfo.wilkescounty.net/

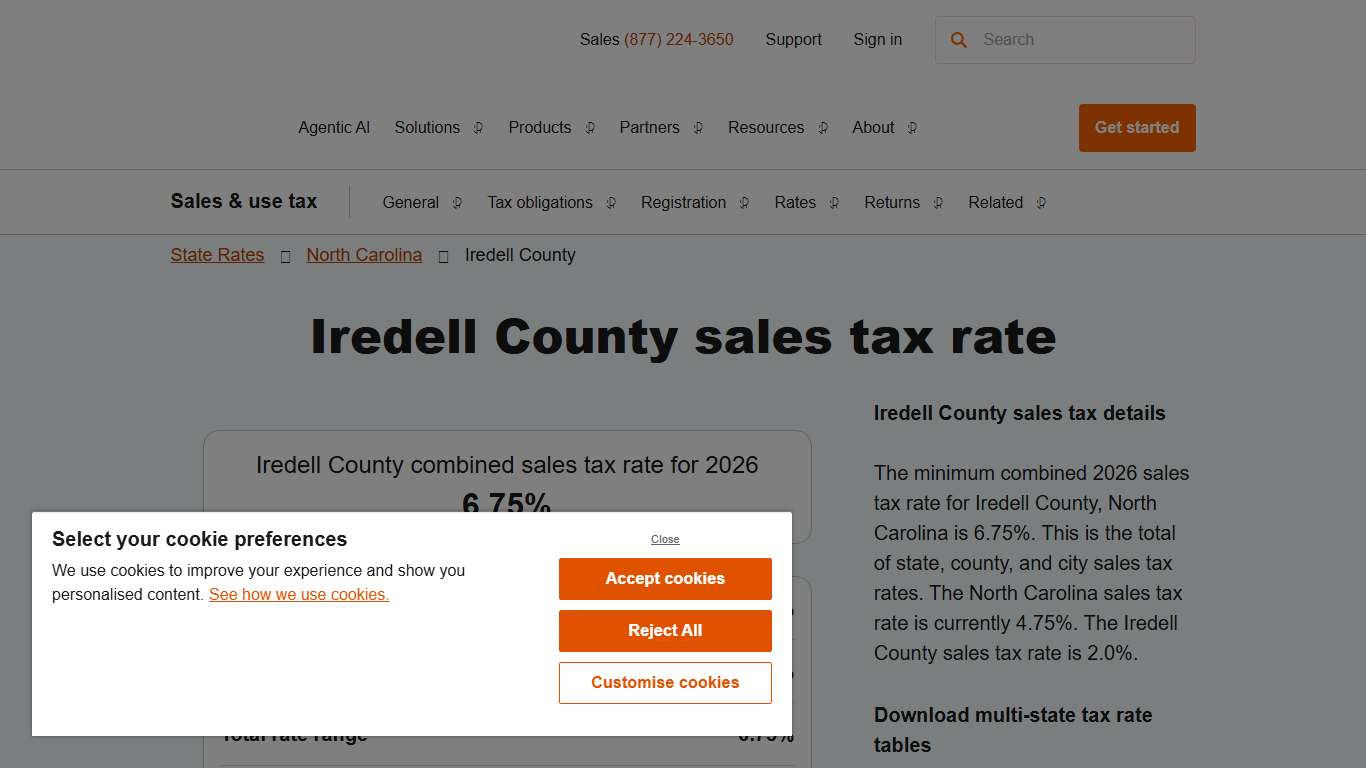

2026 Iredell County County Sales Tax Rate - Avalara

Iredell County sales tax details The minimum combined 2026 sales tax rate for Iredell County, North Carolina is 6.75%. This is the total of state, county, and city sales tax rates. The North Carolina sales tax rate is currently 4.75%. The Iredell County sales tax rate is 2.0%.

https://www.avalara.com/taxrates/en/state-rates/north-carolina/counties/iredell-county.html

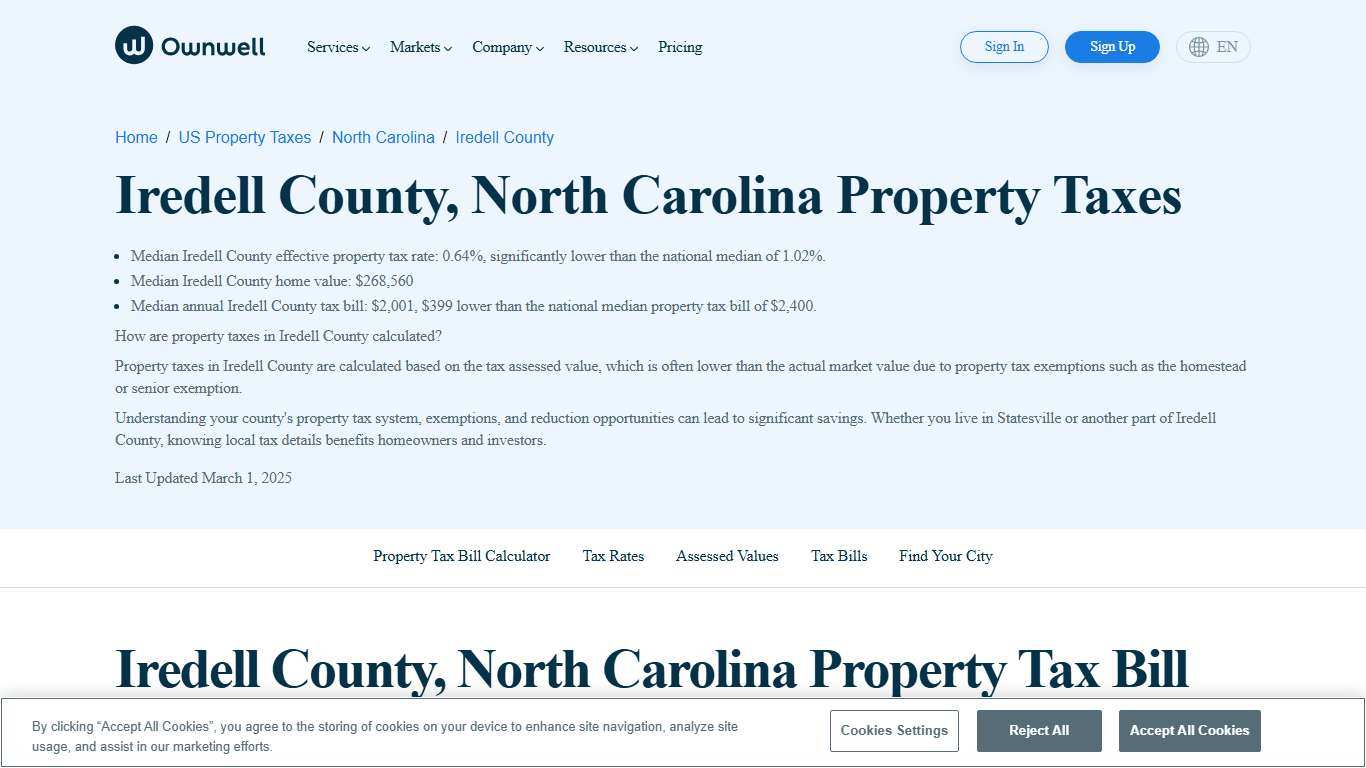

Iredell County, North Carolina Property Taxes - Ownwell

Iredell County, North Carolina Property Taxes Median Iredell County effective property tax rate: 0.64%, significantly lower than the national median of 1.02%. Median Iredell County home value: $268,560 Median annual Iredell County tax bill: $2,001, $399 lower than the national median property tax bill of $2,400.

https://www.ownwell.com/trends/north-carolina/iredell-county

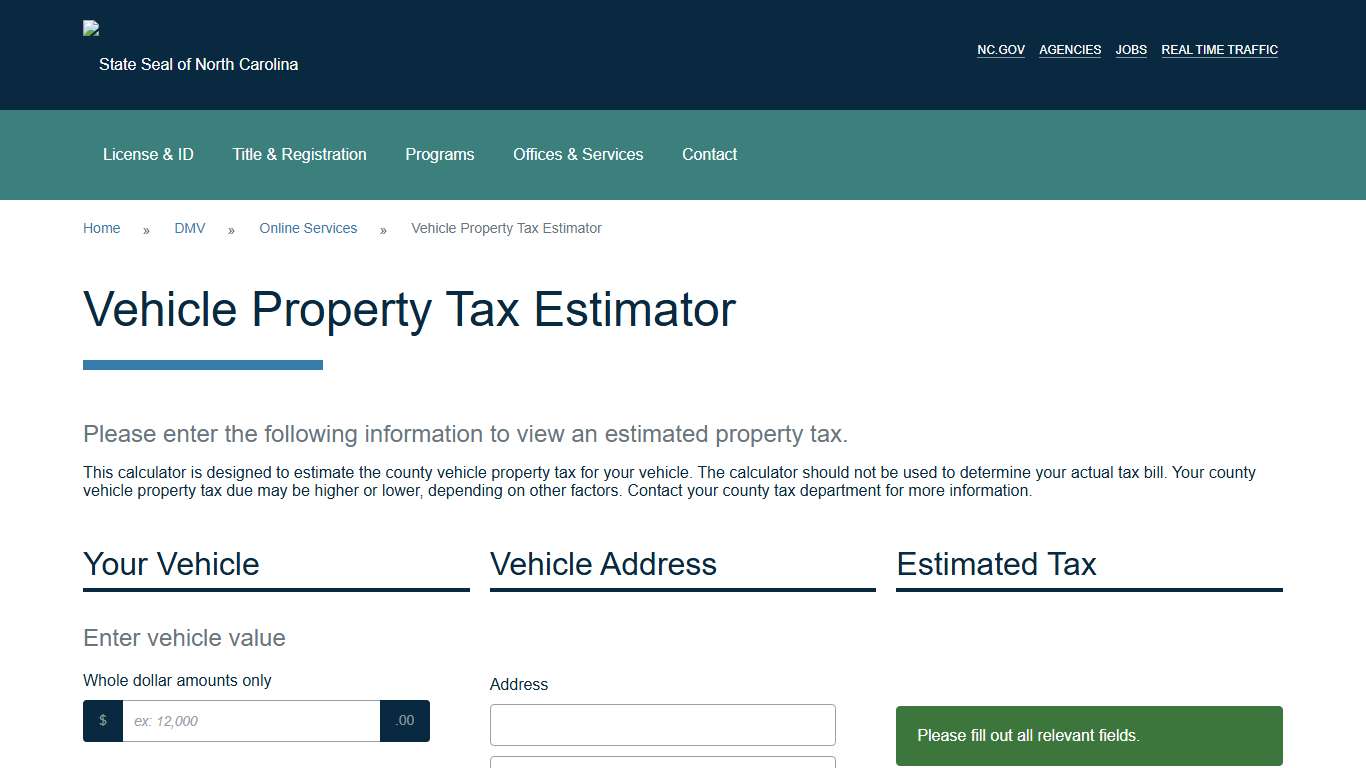

North Carolina Vehicle Property Tax Estimator

Please enter the following information to view an estimated property tax. This calculator is designed to estimate the county vehicle property tax for your vehicle. The calculator should not be used to determine your actual tax bill. Your county vehicle property tax due may be higher or lower, depending on other factors. Contact your county tax department for more information.

https://edmv.ncdot.gov/TaxEstimator